State of Crypto Web Traffic - A 16 Month Prospective

In January 2022 it looked like the crypto industry was about to take over the world. Than they launched a PR campaign

We are just past the one year anniversary of the crypto industry’s high point. On January 24, Paris Hilton went on The Tonight Show with Jimmy Fallon to talk about their Bored Ape NFTs. The deeply awkward segment was met with widespread derision and mockery. It took less than a week for Max Read to report this segment was part of a large scale PR operation run by CAA to help boost their clients’ investments in a network of crypto businesses. The same week as The Tonight Show Segment, YouTuber and video essayist Dan Olson dropped a two and a half hour documentary called Line Goes Up – The Problem With NFTs. In the documentary, Olson walks through the culture and business model of the crypto industry in general and the Potemkin Village of NFTs in particular. According to SocialBlade, a Youtube analytics platform, Line Goes Up saw a spike in traffic following The Tonight Show segment.

If Jimmy and Paris’s paid promo was an awkward appetizer, the Super Bowl was the sad meal. According to the New York Times, EToro, Crypto.com, and FTX US all bought ad space during the game. Having Tom Brady, Matt Damon and Larry David in these high profile ads should have been the coming out party for these new brands. Beth Egan, an associate professor of advertising at Syracuse University, told The New York Times:

These companies are conveying that we’re not this weird little nerdy kid in the corner who’s doing sort-of shifty stuff. ‘We are a real company, a real advertiser, we’re here to stay, we’re mainstream.’

Instead, Bitcoin has lost 50% of its value. It peaked at $47,000 the first week of March and has fallen to around $22,000 at the time I am writing this.

So let’s take a look at where this booming industry is one year out from the peak.

A Short Note on Methodology

First, let’s have a quick chat about methodology. For this analysis, I am looking at traffic from 19 of the top crypto websites based on US traffic. This list, and the traffic data, was collected from publicly available data from SimilarWeb.com. These 19 websites include the largest US accessible trading sites, crypto specific news websites, and tool websites. I picked these sites based on share of traffic data from SimilarWeb and SEMRush, as well as by looking at the top results from Google for searches such as “buying crypto currency” or “bitcoin trading.” Also note, TheBlock.co did not launch until mid–2022. Finally, SimilarWeb dropped the “search” channel from the data set in January 2023.

To No One’s Surprise, Traffic is Down

That’s it. That’s the whole section.

Web traffic to crypto websites had already peaked. In November 2021, US traffic to websites in the data set peaked at 216,757,010 total visits. Traffic fell an average of 15% each month for the next five months. Over the course of the last 15 months, the only thing that drove up traffic was the total collapse of FTX in November 2022.

But let’s get back to The Tonight Show segment and the Super Bowl Ads. These two events represent two large paid media awareness building campaigns. Super Bowl ads and celebrity endorsements are meant to drive interest. The goal of these PR driven paid events is to spur viewers to seek out information about the brands.

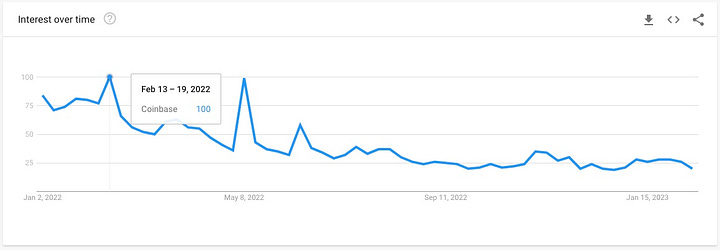

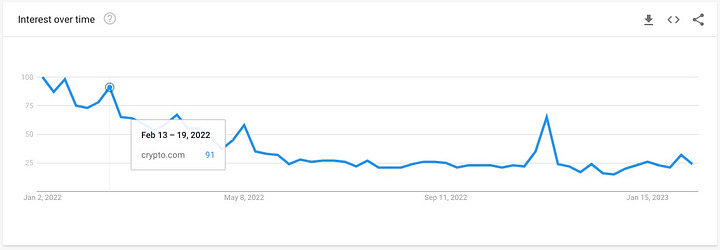

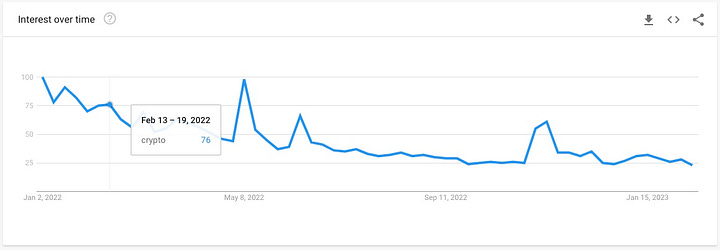

After big paid PR events we would expect to see an increase in search interest. Instead, we see some small relative bumps before a steady downward trend. Coinbase saw organic search fall 27% between January 2022 and February 2022 and 11% into March. Crypto.com saw a 33% and 9% drop in traffic. FTX.us saw a 9% month-over-month increase in February, but a 30% month-over-month decrease into March. Shifting to direct traffic, the Super Bowl advertisers did not fair much better. Coinbase lost 11% of their direct traffic each month in Q1 2022, crypto.com lost 24% and FTX.us lost 2%. For companies that just spent $6.5 million dollars per 30 seconds, not exactly the return you would want to see. Of the Super Bowl Advertisers, only FTX really seemed to come up net neutral.

By the summer, things had become even more bleak. Coinbase and FTX.us had lost about 50% of their traffic. Crypto.com had lost 75%. As the value of cryptocurrencies dropped, so did traffic.

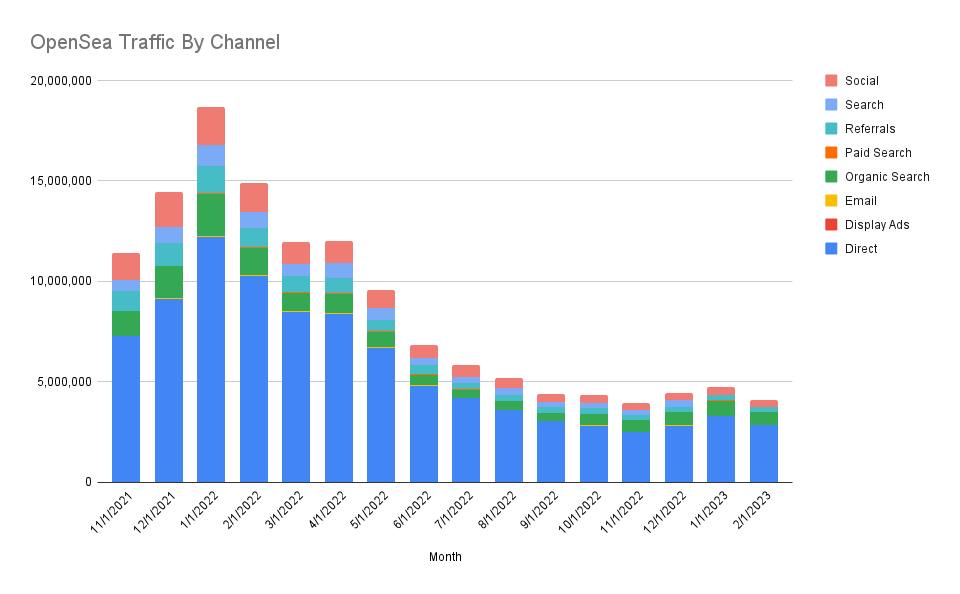

Tracking web traffic for the Bored Ape Yacht Club NFTs is less straight forward. NFTs are, in essence, digital trading cards. They can be bought and sold through exchanges. BAYC NTFs are sold exclusively on an exchange called OpenSea.io. OpenSea’s traffic peaked on January 20, 2022, 4 days before the Tonight Show segment. The following day, January 25th, was the exchange’s 8th best day. There were two other small spikes in traffic over the next two weeks, but that was really it.

Traffic fell 20% in February and March. Over the next few months, OpenSea’s traffic fell 9.5%. This is in contrast to the months leading up to their big PR push. It was only after these products were exposed to a broad popular audience that we started to see traffic fall. I will come back to this shortly. What is striking is how little traffic was coming from channels where you would expect new users to come. Organic Search and social each represented about 9% of OpenSea’s traffic. Referral around 6%. Instead, two thirds of their traffic was coming directly to the website. This implies that most of their traffic were either already in that site’s ecosystem or in the broader crypto ecosystem [1].

The media blitz was meant to bring in mainstream users with a fresh source of cash. That’s not really how it turned out.

Shifty Stuff

I don’t think I need to relitigateState of Crypto Web Traffic - A 15 Month Prospective

We are just past the one year anniversary of the crypto industry’s high point. On January 24, Paris Hilton went on The Tonight Show with Jimmy Fallon to talk about their Bored Ape NFTs. The deeply awkward segment was met with widespread derision and mockery. It took less than a week for Max Read to report this segment was part of a large scale PR operation run by CAA to help boost their clients’ investments in a network of crypto businesses. The same week as The Tonight Show Segment, YouTuber and video essayist Dan Olson dropped a two and a half hour documentary called Line Goes Up – The Problem With NFTs. In the documentary, Olson walks through the culture and business model of the crypto industry in general and the Potemkin Village of NFTs in particular. According to SocialBlade, a Youtube analytics platform, Line Goes Up saw a spike in traffic following The Tonight Show segment.

If Jimmy and Paris’s paid promo was an awkward appetizer, the Super Bowl was the sad meal. According to the New York Times, EToro, Crypto.com, and FTX US all bought ad space during the game. Having Tom Brady, Matt Damon and Larry David in these high profile ads should have been the coming out party for these new brands. Beth Egan, an associate professor of advertising at Syracuse University, told The New York Times:

These companies are conveying that we’re not this weird little nerdy kid in the corner who’s doing sort-of shifty stuff. ‘We are a real company, a real advertiser, we’re here to stay, we’re mainstream.’

Instead, Bitcoin has lost 50% of its value. It peaked at $47,000 the first week of March and has fallen to around $22,000 at the time I am writing this.

So let’s take a look at where this booming industry is one year out from the peak.

A Short Note on Methodology

First, let’s have a quick chat about methodology. For this analysis, I am looking at traffic from 19 of the top crypto websites based on US traffic. This list, and the traffic data, was collected from publicly available data from SimilarWeb.com. These 19 websites include the largest US accessible trading sites, crypto specific news websites, and tool websites. I picked these sites based on share of traffic data from SimilarWeb and SEMRush, as well as by looking at the top results from Google for searches such as “buying crypto currency” or “bitcoin trading.” Also note, TheBlock.co did not launch until mid–2022. Finally, SimilarWeb dropped the “search” channel from the data set in January 2023.

To No One’s Surprise, Traffic is Down

That’s it. That’s the whole section.

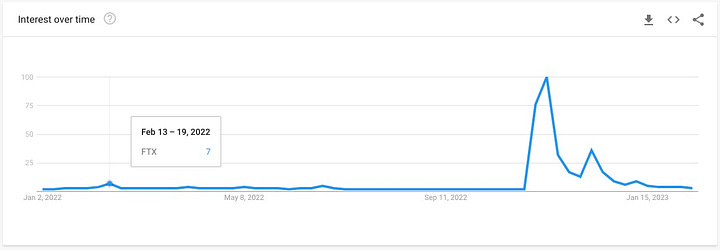

Web traffic to crypto websites had already peaked. In November 2021, US traffic to websites in the data set peaked at 216,757,010 total visits. Traffic fell an average of 15% each month for the next five months. Over the course of the last 15 months, the only thing that drove up traffic was the total collapse of FTX in November 2022.

But let’s get back to The Tonight Show segment and the Super Bowl Ads. These two events represent two large paid media awareness building campaigns. Super Bowl ads and celebrity endorsements are meant to drive interest. The goal of these PR driven paid events is to spur viewers to seek out information about the brands.

After big paid PR events we would expect to see an increase in search interest. Instead, we see some small relative bumps before a steady downward trend. Coinbase saw organic search fall 27% between January 2022 and February 2022 and 11% into March. Crypto.com saw a 33% and 9% drop in traffic. FTX.us saw a 9% month-over-month increase in February, but a 30% month-over-month decrease into March. Shifting to direct traffic, the Super Bowl advertisers did not fair much better. Coinbase lost 11% of their direct traffic each month in Q1 2022, crypto.com lost 24% and FTX.us lost 2%. For companies that just spent $6.5 million dollars per 30 seconds, not exactly the return you would want to see. Of the Super Bowl Advertisers, only FTX really seemed to come up net neutral.

By the summer, things had become even more bleak. Coinbase and FTX.us had lost about 50% of their traffic. Crypto.com had lost 75%. As the value of cryptocurrencies dropped, so did traffic.

Tracking web traffic for the Bored Ape Yacht Club NFTs is less straight forward. NFTs are, in essence, digital trading cards. They can be bought and sold through exchanges. BAYC NTFs are sold exclusively on an exchange called OpenSea.io. OpenSea’s traffic peaked on January 20, 2022, 4 days before the Tonight Show segment. The following day, January 25th, was the exchange’s 8th best day. There were two other small spikes in traffic over the next two weeks, but that was really it.

Traffic fell 20% in February and March. Over the next few months, OpenSea’s traffic fell 9.5%. This is in contrast to the months leading up to their big PR push. It was only after these products were exposed to a broad popular audience that we started to see traffic fall. I will come back to this shortly. What is striking is how little traffic was coming from channels where you would expect new users to come. Organic Search and social each represented about 9% of OpenSea’s traffic. Referral around 6%. Instead, two thirds of their traffic was coming directly to the website. This implies that most of their traffic were either already in that site’s ecosystem or in the broader crypto ecosystem [1].

The media blitz was meant to bring in mainstream users with a fresh source of cash. That’s not really how it turned out.

People Wanted the Shifty Stuff…But Not in the Way You Think

EToro, Crypto.com, Coinbase, and FTX all went out into the marketplace with the message “Only losers don’t invest in bitcoin” and the market place ignored them. People looked at those company’s offerings and concluded that it was in fact “shifty stuff”. What happened next is exactly what Dan Olson predicted would happen. When new money failed to flow into the system, the line started to go down. Without new money coming in at the bottom the people at the top looking for payouts had to start taking a haircut on the value of their investments. The value of Bitcoin, Ethereum and other coins fell because fewer people were willing to buy at the top of the market. Enthusiasm fell. Fewer people were visiting these sites. And the cycle repeats.

In the months that followed, we saw the price of Bitcoin drop 50%. Many businesses built on the hype failed. Some because of mismanagement, others because of outright fraud. It is only in October 2022 we start to see any real upward shift in traffic.

Without getting to much detail, the drop in value in bitcoin in the first half of 2022 had many knock on effects. The bubble bursting caused a number of large bitcoin and crypto businesses to collapse. Through the summer and into the fall the contagion from these spread across the sector. By October 2022, this news started to break into the general business press. The effects of the crypto bubble popping started to reach mainstream financial institutions. In partially, the coverage of the two largest crypto trading platforms Binance and FTX bidding to take control of failing crypto based hedge fund Voyager Digital brought a lot of mainstream attention to the scale of these companies and the crypto industry.

This attention again exploded in the first week of November when FTX fully collapsed. Here is where we start to see organic search traffic to crypto sites really spike. Coinbase saw a 260% increase in organic search visits. Crypto.com had a 170% increase in search visits and Binance had a 70%. But it was the crypto-centric news publishers that saw the most action. Search traffic to Coindesk had an increase of 112% in search visits, Decrypt.co a 255% increase, and theblock.co[2] a 495% increase.

In the end it was the rubberneckers basking in the schadenfreude of cryptos collapse. Users flooded into crypto sites to watch the whole house of cards burn to the ground.

This is maybe where we push up against the limits of SimilarWeb’s data. So let’s get two caveats out of the way. SimilarWeb is going to staff any traffic it can’t understand the “Direct” category. Any traffic coming to OpenSea coming from Web3 apps is going to placed into direct. Now, it is likely that web3 app traffic is already going to be people already owned traffic. People using MetaMask or other wallets are going to called “direct” traffic. The other thing you might hear is that people into crypto use the Brave web browser and Duck Duck Go. Brave and DDG have pretty small market share. Both have less than 1% of the browser market. Also, The thing I are tried to pin down is where the traffic is coming from. If users are using Brave and DDG, they are likely already the crypto ecosystem. People already using Brave and DDG, also likely in the ecosystem.

In December 2022, Axios reported that TheBlock.co had been secretly funded by Sam Bankman-Fried. Bankman-Fried is the head of FTX.